5 Key Facts About the Tax-Free Savings Account (TFSA) You Need to Know. Are you looking for a powerful tool to grow your savings and investments without paying taxes? You’ve likely heard of the Tax-Free Savings Account (TFSA), but understanding its full potential can be complex. The idea of tax-free growth is incredibly appealing, yet many Canadians miss out on this opportunity because they’re unsure how it works. This is a common problem, as navigating the rules around contributions, withdrawals, and eligible investments can seem daunting. Let’s solve this by breaking down everything you need to know about the Tax-Free Savings Account (TFSA) to help you make informed decisions and build a stronger financial future.

Understanding the Tax-Free Savings Account (TFSA)

A Tax-Free Savings Account (TFSA) is a registered savings plan that was introduced by the Canadian government in 2009. The primary benefit is that any investment income, including capital gains and dividends, earned within the account is completely tax-free. This includes when you withdraw the funds, making it an excellent vehicle for both short-term savings and long-term investment goals. It’s important to remember that this isn’t just a simple savings account; it’s a “wrapper” that can hold a variety of investments. You can open a TFSA at most financial institutions in Canada, including banks, credit unions, and online brokerages.

Many people use their TFSA for different purposes. Some use it to save for a down payment on a house, while others use it for retirement planning, supplementing their Registered Retirement Savings Plan (RRSP). The flexibility of the TFSA is one of its biggest advantages. Unlike an RRSP, contributions to a TFSA are not tax-deductible, but this is a trade-off for the tax-free growth and withdrawals. Let’s delve into the specific details that make the Tax-Free Savings Account (TFSA) so effective.

Contribution Limits and How They Work

Each year, the government sets a new contribution limit for the TFSA. This limit is the maximum amount of new money you can contribute in that calendar year. However, your total contribution room is cumulative. This means that any unused room from previous years is carried forward and added to the current year’s limit. For example, if you turned 18 in 2009 and have never contributed, you would have the total accumulated contribution room available. This is a crucial point for anyone who is just starting to save or has a significant amount of money to invest. You can find your personal TFSA contribution room on your Canada Revenue Agency (CRA) My Account. Over-contributing to your TFSA can result in a penalty of 1% per month on the excess amount, so it’s vital to track your contributions carefully.

Eligible Investments in a TFSA

A common misconception is that a TFSA can only hold cash in a savings account. In reality, a wide range of investment products are eligible to be held within a TFSA. These include stocks, bonds, mutual funds, ETFs (Exchange-Traded Funds), and GICs (Guaranteed Investment Certificates). This flexibility is what makes it such a powerful wealth-building tool. Instead of just earning minimal interest in a traditional savings account, you can invest in assets with a higher potential for growth, and all the returns are tax-free. It’s a great way to grow your money, whether you’re a conservative or aggressive investor. The choice of what to invest in depends on your financial goals, risk tolerance, and time horizon.

Eligible Investments in a TFSA

| Investment Type | Description | Examples |

|---|---|---|

| Cash | Simple deposits; any interest earned is tax-free | CAD or USD cash deposits |

| GICs (Guaranteed Investment Certificates) | Principal is guaranteed; pays a fixed interest for a set term | Bank GICs, Credit Union GICs |

| Mutual Funds | Professionally managed pools of money from many investors | Equity funds, Bond funds, Balanced funds |

| ETFs (Exchange-Traded Funds) | Traded like stocks on an exchange; typically low-cost | S&P 500 ETF, TSX Composite ETF |

| Stocks | Only stocks listed on designated Canadian and U.S. exchanges are eligible | RBC, TD, Apple, Microsoft |

| Bonds | Debt securities issued by governments or corporations | Government of Canada bonds, Corporate bonds |

| Certain Options | Limited options allowed under CRA rules | Covered calls, Warrants (if eligible) |

| Other Qualified Investments | Specific instruments recognized by CRA | Index-linked GICs, Mortgage-backed securities |

⚠️ Important Notes

-

Ineligible investments include private company shares, cryptocurrencies, and some derivatives. Holding these can result in severe penalties (e.g., 50% of the investment’s value).

-

The CRA (Canada Revenue Agency) updates the eligibility list periodically, so always double-check before investing.

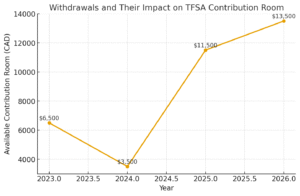

Withdrawals and Their Impact on Contribution Room

One of the most appealing features of a TFSA is the ability to make tax-free withdrawals at any time for any reason. Whether you need the money for an emergency, a vacation, or a major purchase, you can access your funds without penalty. This is a significant difference from an RRSP, where withdrawals are generally taxed. What’s even better is that when you withdraw funds from your TFSA, your contribution room is restored in the following calendar year. For example, if you have a TFSA with a balance of $10,000 and withdraw the entire amount, you can re-contribute that $10,000 in the next year, in addition to the new annual contribution limit. This “re-contribution” rule is a key feature of the Tax-Free Savings Account (TFSA) and a major benefit for those who may need access to their funds in the future.